Not known Factual Statements About Clark Wealth Partners

Wiki Article

The Buzz on Clark Wealth Partners

Table of ContentsClark Wealth Partners Fundamentals ExplainedThe Greatest Guide To Clark Wealth PartnersClark Wealth Partners - TruthsUnknown Facts About Clark Wealth PartnersClark Wealth Partners Things To Know Before You Get This

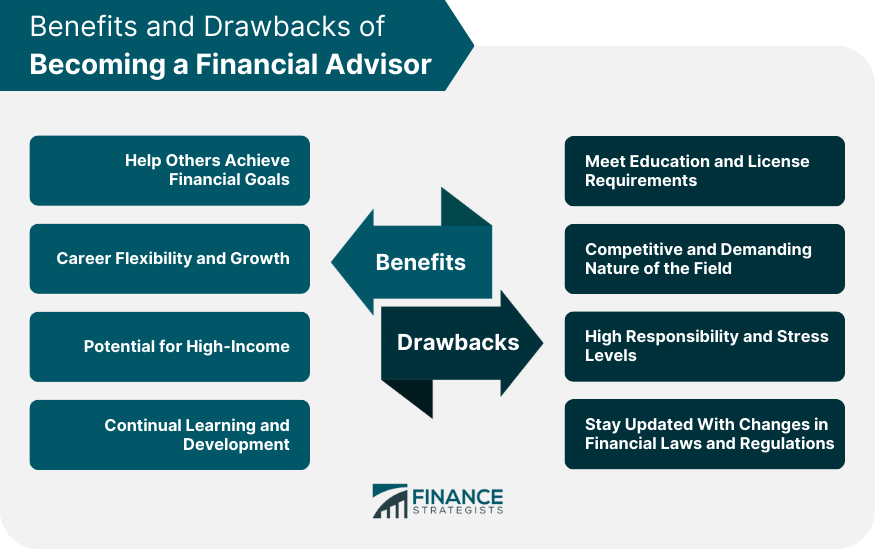

Put simply, Financial Advisors can take on component of the responsibility of rowing the boat that is your monetary future. A Financial Expert must function with you, not for you. In doing so, they must function as a Fiduciary by putting the most effective passions of their clients above their own and acting in excellent faith while supplying all relevant facts and preventing problems of rate of interest.Not all connections are effective ones. Possible downsides of collaborating with a Financial Consultant include costs/fees, high quality, and possible desertion. Disadvantages: Costs/Fees This can easily be a positive as high as it can be a negative. The secret is to see to it you obtain what your spend for. The claiming, "rate is an issue in the absence of value" is precise.

Absolutely, the goal must be to seem like the guidance and service received are worth greater than the prices of the partnership. If this is not the case, after that it is an adverse and thus time to reassess the relationship. Cons: High Quality Not all Monetary Advisors are equal. Equally as, not one expert is excellent for every single prospective client.

The Single Strategy To Use For Clark Wealth Partners

A client should constantly be able to address "what happens if something occurs to my Financial Expert?". It starts with due diligence. Constantly appropriately veterinarian any type of Financial Expert you are considering functioning with. Do not depend on promotions, awards, qualifications, and/or referrals exclusively when seeking a connection. These means can be utilized to limit the pool no question, yet then handwear covers need to be placed on for the remainder of the work.when interviewing experts. If a certain area of know-how is needed, such as collaborating with executive comp strategies or setting up retired life plans for small company proprietors, find consultants to interview that have experience in those arenas. Once a connection starts, remain purchased the connection. Working with a Monetary Expert should be a partnership - financial planner in ofallon illinois.

It is this sort of effort, both at the start and via the partnership, which will certainly aid highlight the advantages and hopefully minimize the disadvantages. Do not hesitate to "swipe left" many time prior to you ultimately "swipe right" and make a solid connection. There will be a price. The function of a Monetary Advisor is to help customers establish a plan to satisfy the economic goals.

That work includes fees, occasionally in the types of asset monitoring fees, payments, preparing fees, financial investment product costs, etc - financial advisor st. louis. It is essential to comprehend all costs and the structure in which the consultant runs. This is both the obligation of the consultant and the customer. The Financial Advisor is in charge of providing value for the costs.

What Does Clark Wealth Partners Do?

Preparation A service strategy is essential to the success of your service. You require it to understand where you're going, just how you're arriving, and what to do if there are bumps in the roadway. An excellent financial expert can create a comprehensive strategy to help you run your service more effectively and plan for anomalies that occur.

It's all concerning making the best economic choices to enhance your opportunities of success. They can assist you toward the best possibilities to boost your earnings. Minimized Tension As a company proprietor, you have lots of things to fret about. A great economic advisor can bring you comfort recognizing that your finances are getting the focus they require and your money is being invested sensibly.

Sometimes company owners are so focused on the everyday grind that they shed view of the huge photo, which is to make a revenue. A monetary consultant will look at the overall state of your finances without obtaining feelings entailed.

Top Guidelines Of Clark Wealth Partners

There are many advantages and disadvantages to think about when working with an economic advisor. They can give useful experience, particularly for complex financial planning. Advisors deal personalized methods customized to individual goals, possibly causing far better monetary results. They can additionally relieve the tension of taking care of financial investments and economic choices, supplying assurance.

The expense of working with an economic advisor can be significant, with charges that may affect general returns. Financial planning can be frustrating. We recommend consulting with a financial advisor. This free device will match you with vetted consultants who offer your location. Right here's how it functions:Respond to a few very easy concerns, so we can discover a match.

Discover Your Expert People turn to economic experts for a myriad of reasons. The possible benefits of employing a consultant consist of the knowledge and understanding they supply, the customized recommendations they can give and the long-lasting discipline they can infuse.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Advisors learn specialists that remain upgraded on market trends, investment strategies and financial policies. This understanding allows them to give understandings that could not be easily evident to the typical person - https://creativemarket.com/users/clarkwealthpt. Their knowledge can aid you navigate intricate financial scenarios, make notified choices and possibly surpass what you would accomplish on your very ownReport this wiki page