The 45-Second Trick For Custom Private Equity Asset Managers

Wiki Article

About Custom Private Equity Asset Managers

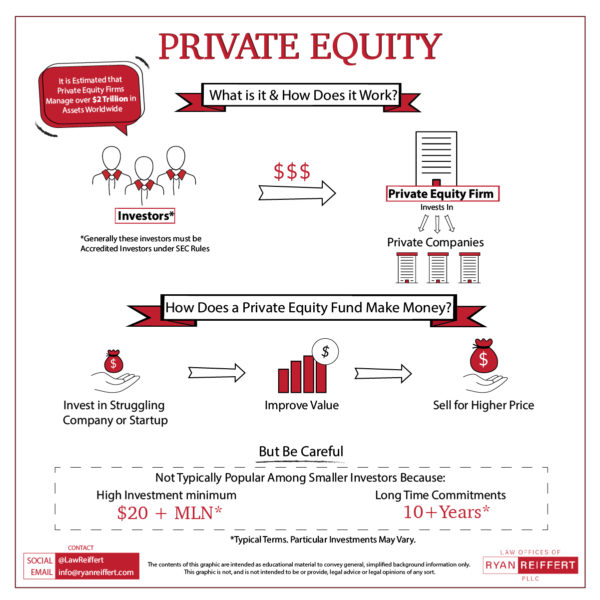

(PE): investing in business that are not publicly traded. Approximately $11 (https://www.openlearning.com/u/madgestiger-s56is4/about/). There might be a couple of points you do not recognize regarding the sector.

Exclusive equity companies have a variety of financial investment choices.

Since the most effective gravitate toward the larger deals, the center market is a dramatically underserved market. There are extra vendors than there are very experienced and well-positioned financing experts with comprehensive purchaser networks and resources to take care of a bargain. The returns of private equity are generally seen after a couple of years.

Getting My Custom Private Equity Asset Managers To Work

Traveling listed below the radar of huge multinational firms, a number of these small business commonly supply higher-quality client service and/or specific niche products and solutions that are not being used by the big empires (https://slides.com/cpequityamtx). Such advantages attract the rate of interest of exclusive equity firms, as they possess the understandings and smart to manipulate such chances and take the company to the following level

A lot of managers at profile business are provided equity and reward settlement frameworks that award them for hitting their monetary targets. Personal equity opportunities are usually out of reach for people who can not invest millions of bucks, however they shouldn't be.

There are laws, such as limits on the aggregate amount of cash and on the variety of non-accredited capitalists. The exclusive equity company draws in several of the best and brightest in business America, consisting of top performers from Ton of money 500 firms and elite management consulting firms. Law practice can likewise be recruiting premises for private equity employs, as accounting and lawful abilities are required to full bargains, and purchases are very looked for after. https://myanimelist.net/profile/cpequityamtx.

The Buzz on Custom Private Equity Asset Managers

An additional negative aspect is the absence of liquidity; as soon as in a personal equity transaction, it is not very easy to get out of or offer. With funds under administration already in the trillions, personal equity companies have come to be attractive investment cars for rich people and establishments.

For years, the attributes of private equity have actually made the asset class an attractive proposal for those who might take part. Since accessibility to private equity is opening as much as even more specific financiers, the untapped possibility is coming to be a reality. The concern to take into consideration is: why should you invest? We'll begin with the main debates for spending in private equity: How and why personal equity returns have actually traditionally been more than various other assets on a number of levels, Just how including personal equity in a profile impacts the risk-return account, by aiding to expand versus market and cyclical risk, Then, we will certainly describe some vital factors to consider and threats for personal equity capitalists.

When it pertains to introducing a brand-new property into a portfolio, the most basic factor to consider is the risk-return account of that property. Historically, private equity has displayed returns comparable to that of Emerging Market Equities and more than all other traditional property courses. Its reasonably low volatility coupled with its high returns produces a compelling risk-return profile.

why not try this outAll About Custom Private Equity Asset Managers

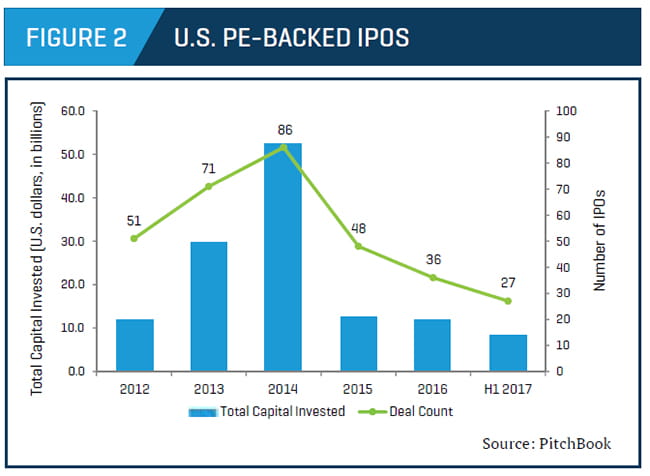

Private equity fund quartiles have the best range of returns across all alternative asset classes - as you can see listed below. Approach: Interior price of return (IRR) spreads determined for funds within classic years independently and afterwards balanced out. Median IRR was determined bytaking the average of the median IRR for funds within each vintage year.

The takeaway is that fund selection is vital. At Moonfare, we execute a strict option and due persistance procedure for all funds noted on the system. The effect of adding exclusive equity into a profile is - as always - based on the portfolio itself. Nevertheless, a Pantheon study from 2015 suggested that consisting of exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the most effective exclusive equity firms have access to an even bigger pool of unknown chances that do not deal with the same examination, in addition to the sources to do due diligence on them and determine which are worth investing in (Private Investment Opportunities). Spending at the ground flooring indicates higher danger, but also for the firms that do succeed, the fund gain from higher returns

The Best Guide To Custom Private Equity Asset Managers

Both public and exclusive equity fund supervisors commit to investing a percent of the fund however there remains a well-trodden issue with straightening passions for public equity fund management: the 'principal-agent problem'. When a financier (the 'major') hires a public fund supervisor to take control of their resources (as an 'agent') they pass on control to the manager while retaining ownership of the assets.

In the case of personal equity, the General Partner doesn't simply earn an administration fee. Personal equity funds likewise mitigate an additional type of principal-agent issue.

A public equity capitalist inevitably desires something - for the administration to increase the supply cost and/or pay out rewards. The financier has little to no control over the decision. We revealed above how lots of private equity strategies - specifically majority acquistions - take control of the operating of the business, guaranteeing that the lasting value of the firm comes initially, pushing up the return on financial investment over the life of the fund.

Report this wiki page